PayU Releases Innovative SKD for Cross-device Online Payments

PayU, a leading provider of online payment solutions in India, is making significant strides in the mobile app development space with its three innovative Software Development Kits (SDKs). These groundbreaking SDKs are specifically designed to cater to the growing demand for seamless payment experiences on mobile devices, resulting in a remarkable increase of up to 5-6% in transaction success rates.

What the Release Entails

The latest SDK releases from PayU have been meticulously engineered to simplify the payment process, reduce checkout steps, and significantly enhance transaction success rates across a wide range of payment methods.

One of the notable SDKs introduced by PayU is the Native Payment Experience on 3DS 2.0. PayU takes pride in being the first in the industry to offer a seamless Native OTP experience for card transactions through an EMVCo certified SDK. This groundbreaking solution ensures complete coverage across all issuers and cards, while also complying with global security standards.

Another remarkable SDK is the UPI BOLT, a collaborative effort between PayU and Axis Bank that revolutionizes UPI payments. Built on the robust UPI Plug In SDK infrastructure provided by NPCI, this solution empowers merchants to seamlessly integrate PayU’s UPI BOLT SDK with minimal changes, resulting in a simplified and efficient payment experience.

Furthermore, PayU’s collaboration with MinkasuPay introduces a game-changing biometric solution called One-Click Net Banking. This innovative partnership eliminates the need for usernames, passwords, and OTPs, streamlining the customer journey within merchant apps. By compressing a complex 30-step process into a seamless one-click experience, customers of PayU’s partner banks can effortlessly make payments using their fingerprint or Face ID, with the added option of a secure PayPIN.

What This Means for Customers

If you’re just a user of PayU, the takeaway is simple. Online payments in India are set to become quicker and easier than ever before. Moreover, you can expect fees and extra steps to be brought down to a minimum.

Considering projections indicate that more than 72% of all transactions in India will be digital by 2025, these developments are quite important. Naturally, PayU online casinos will also become quite a bit more attractive.

Popular

Recent

Online Casino Payment Safety

Staying safe is of the utmost importance while gambling […]

02.02.2023

The Mobile Payments Market Is Surging

With modern banking technologies being integrated into mobile devices, […]

02.02.2023

The Netherlands Have Successfully Integrated Visa and Mastercard Debit

After a lengthy period of time, the Dutch Payments […]

02.02.2023

The Lost Diamond Promotion Awaits At BitStarz With €50.000 in Rewards

BitStarz is hosting an African savanna-themed promotion titled The […]

16.02.2024

Pennsylvania Bill Proposes to Ban Credit Card Payments in Online Casinos

A new bill proposed in the Senate of the […]

25.04.2024

Daily Cashback for Slots on Twin Casino

Every bit of gambling has a downside – the […]

18.04.2024

PayU Releases Innovative SKD for Cross-device Online Payments

PayU, a leading provider of online payment solutions in […]

07.04.2024

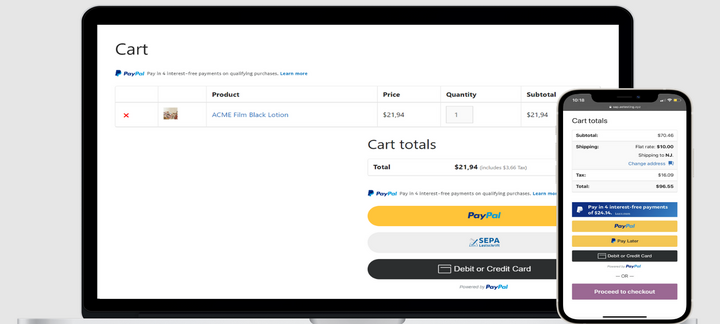

PayPal Extends Offer With PayPal Complete Payments

PayPal has launched a new service called PayPal Complete […]

22.03.2024